The CA Thingy

Why You Should Ditch Spreadsheets for Invoicing

March 30, 2025

If you’re still using Excel or Google Sheets to manage your invoicing, you’re not alone—but you’re definitely working harder than you need to. From formula mishaps to missing payments, spreadsheets come with hidden costs. This blog breaks down why modern invoicing tools are the smarter, faster, and more professional choice for today’s CA.

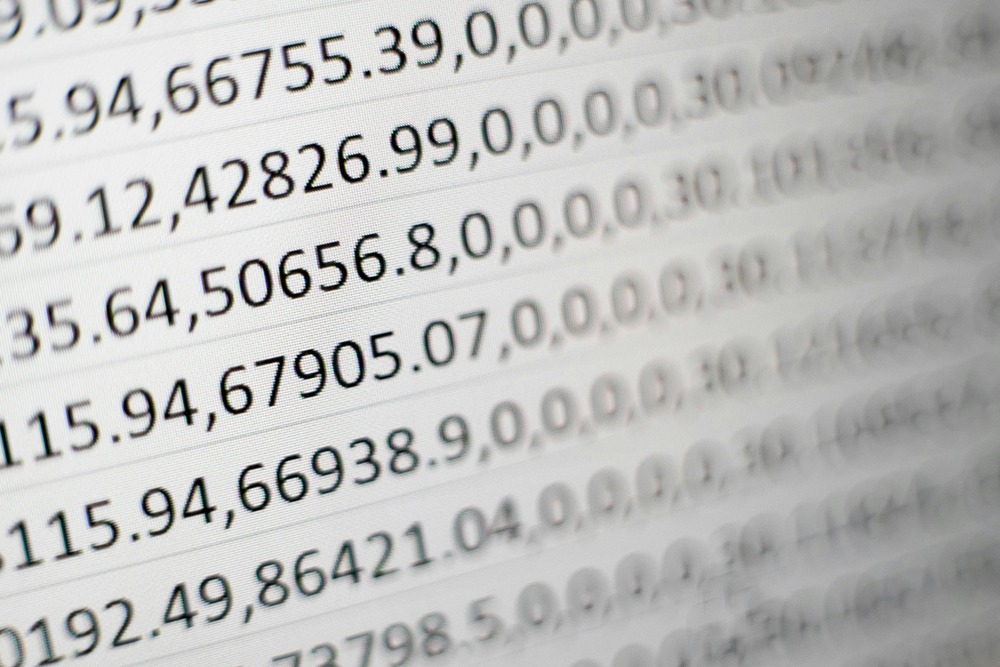

1. Spreadsheets Aren’t Built for Invoicing

- You have to manually input client details, dates, amounts, and taxes—every single time.

- There's no built-in logic for recurring invoices, auto-calculation, or payment tracking.

- A small copy-paste error can lead to big financial mistakes.

2. You Look Less Professional

- Invoices made in spreadsheets often lack polish and consistency.

- No brand logo, no proper formatting, and no invoice history.

- Clients expect clean, professional documents—especially if you’re charging a premium.

3. No Automation = Wasted Hours

- Want to send a reminder for unpaid invoices? You’ll need to track that manually.

- Want to know who paid what last month? Get ready to filter, sort, and squint.

- Invoicing tools do all this automatically—with dashboards, filters, and reminders built in.

4. GST & Compliance Made Harder

- Adding GST manually? Hope you double-checked every formula.

- Forget about e-invoicing or GSTR-1 exports—spreadsheets don’t help here.

- A good invoicing tool ensures tax rules are followed and reports are always ready.

5. The CA Thingy Makes It Seamless

- Generate branded invoices in 1 click.

- Auto-fill client details and calculate taxes.

- Get reminders for unpaid invoices.

- Export GSTR-ready data when you need it.

Final Thoughts

- You became a CA to solve client problems—not to fight spreadsheets.

- Invoicing tools free you from manual errors and wasted hours.

- If you’re serious about growth and professionalism, it’s time to upgrade.